Many Australians haven’t considered saving for aged care by the time they reach retirement. Yet most retirees will need some form of assistance, from everyday tasks to more comprehensive care. Earlier findings showed that only around 40% of older Australians are worried about the cost of aged care. While this may reflect optimism or reliance on government support, the rising costs of services mean planning ahead is essential to avoid unexpected financial pressure.

When does the average older Australlian begin saving for aged care?

Those yet to start saving for aged care

-Those-yet-to-Start-Saving-for-Aged-Care-Edited.png)

Our research shows that a significant proportion of Australians have yet to start planning or saving for aged care. Overall, around two-thirds (64.5%) of people fall into this category. This includes those who haven’t started and don’t plan to (41.5%), as well as those who intend to start saving in the next 1–2 years (9.2%), 3–5 years (5.4%), or 6–10 years (8.3%).

Those who have started saving for aged care

-Those-Who-Have-Started-Saving-for-Aged-Care-Edited.png)

Conversely, 35.5% of Australians have already begun saving for aged care, though the age at which they started varies. Some began as early as their 30s (7.5%) or 40s (6.4%), while others started later in life, during their 50s (9.8%) or 60s and beyond (11.8%).

The data also highlights slight differences between men and women. Women are slightly more likely than men to say they haven’t started saving at all, while men are somewhat more likely to have started earlier in life.

State of residence influences how Australians approach aged care savings. Queensland has the highest share of people who haven’t started and don’t plan to save (45.5%), followed by South Australia (42.1%) and New South Wales (40.6%), while Victoria (39.9%) and Western Australia (39.4%) are slightly lower. Those who have started saving tend to do so earlier in South Australia and Queensland, while later saving is more common in Western Australia and New South Wales. Overall, the data shows notable variation in saving behaviours across states.

These findings suggest that while a portion of Australians are taking proactive steps to prepare for aged care, the majority are yet to prioritise it in their retirement planning. With the costs of aged care rising and the likelihood of needing support increasing with age, these results point to a clear need for greater awareness and planning.

How much are Australians setting aside for aged care?

Although many Australians haven’t started saving for aged care, this section focuses on the 58.5% who either plan to start or have already begun. We examine how much of their predicted retirement savings they are setting aside specifically for aged care, which gives insight into both the perceived cost of care and what individuals expect it will cost them in the future.

The predicted aged cost savings on average between men and women

-the-Predicted-Aged-Cost-Savings-on-Average-between-Men-and-Women-Edited.png)

On average, those planning for aged care are setting aside $312,001, which represents just over half (54.3%) of their total retirement savings. While men are contributing a higher average amount, women are allocating a slightly larger share of their retirement savings to aged care.

This could suggest that women are more cautious in planning for future aged care needs relative to their total retirement funds, or that they anticipate aged care costs that are proportionally higher.

The predicted aged cost savings on average across states

-the-predicted-aged-cost-savings-on-average-across-states-edited.png)

There are some clear differences between states in how much Australians are putting aside for aged care. Queenslanders and Western Australians are leading the way, each allocating well over half of their retirement savings, 58.1% and 56.0% respectively, amounting to around $325,000. In Victoria and New South Wales, people are setting aside slightly less, at $308,882 (53.5%) and $304,955 (52.7%), while South Australians are putting aside the smallest share, averaging $268,189, or 51.6% of their retirement funds.

These figures show that while Australians across the country are recognising the importance of planning for aged care, the amount they allocate can vary considerably depending on where they live. In general, people are dedicating a substantial share of their retirement savings to aged care, reflecting both the anticipated costs and the priority placed on ensuring financial security in later life.

However, in reality, aged care can cost considerably more than many older Australians expect. Depending on the level of support required, from basic in-home assistance to full residential care, the annual cost can vary widely. From 1 November, the average cost per hour for a support worker under the new Support at Home reforms will be around $100, meaning many people may need to budget more than they currently anticipate to cover their care needs.

Do Australians who plan for aged care save more overall?

When we compared predicted retirement funds between those who had factored aged care into their planning and those who hadn’t, a clear gap emerged. Australians who have planned and saved for aged care expect to retire with an average of $574,179, compared to $379,545 among those who haven’t. Women who factored aged care into their plans predicted $497,222 on average, versus $317,281 for those who hadn’t. For men, the gap was even larger, $643,153 compared to $442,229.

This suggests that awareness of future care needs not only prompts people to set aside money for it but may also encourage them to build higher overall retirement savings.

The average predicted retirement savings based on saving attitudes

How familiar are older Australians with the upcoming support at home reforms in Australia?

From 1 November, new Support at Home reforms will change the way in-home aged care is delivered for Australians approaching retirement age, impacting how people access and receive assistance at home.

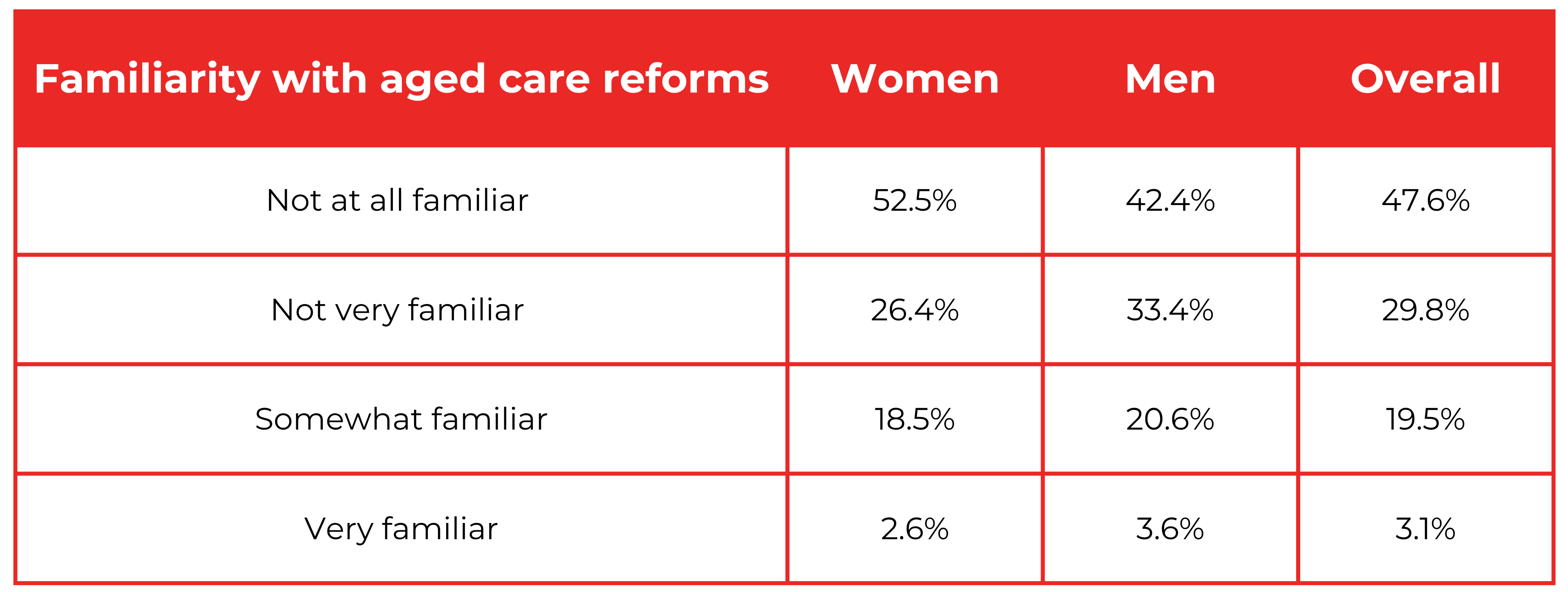

Familiarity with upcoming Support at Home reforms by gender

Our research found that almost half (47.6%) of older Australians are not familiar with these upcoming reforms, highlighting a significant awareness gap. Women were notably more likely than men to be completely unaware, with over 52% of women saying they knew nothing about the changes, compared with 42% of men. A further 29.8% of respondents had only heard a little, making this the second-most-common level of familiarity.

Only one in five (19.5%) reported being somewhat familiar with the reforms, while a very small proportion, 3.1%, felt they fully understood the changes and how these would directly affect them.

Familiarity with upcoming Support at Home reforms by state

.png)

Looking at the states, the picture is pretty similar across the country. Around 45–49% of people in each state say they’re completely unfamiliar with the reforms. Western Australians are a bit more likely to say they’re somewhat familiar (24.8%), while Victorians (32.5%) and New South Wales residents (30.5%) tend to fall into the “not very familiar” category more often than average. Very few people in any state feel they really understand the reforms, just 1.5% in Victoria, up to 4.1% in New South Wales.

These findings are particularly important because the reforms are likely to influence how older Australians plan for aged care, manage in-home support, and make decisions about staying independent. The low levels of awareness suggest that many people may be unprepared for changes that could affect both their care options and retirement planning.

It also underscores the need for targeted communication and education, particularly for women, to ensure everyone can make informed choices about their future support at home.

-the-average-predicted-retirement-savings-based-on-saving-attitudes-edited.png)